MPAC continues to use 2016 values while the province continues a property taxation review. (MPAC Image)

MPAC continues to use 2016 values while the province continues a property taxation review. (MPAC Image)

Prince Edward County added more than $73.2 million in new assessment value to local property rolls in 2025, MPAC’s Catherine Barr reported to Council last week. That was the total from 1,035 sales transactions, 43 severances and consolidations processed, and 891 building permits.

About 83 percent, or $63 million, of the new assessment growth was in the residential column, while farms made up 14 percent or $8.3 million in new tax base growth. Commercial was a distant third at two percent or $1.8 million.

In terms of New Assessment Growth forecasts, MPAC was 98 percent accurate in 2023 and 2024 when predicting growth in Prince Edward County. In 2025, the percentage fell to 91 percent due to a market slowdown.

But like every other municipality in Ontario, the County continues to play a waiting game with the province over a new property assessment cycle. Property values in the province have not been reassessed since 2016.

MPAC continues to assess the value of new builds for municipal taxation purposes. It provides localized growth forecasts and monitors the various property tax classes.

But it does so using pre-pandemic values. Values dating to 2016, to be specific.

In 2020, the provincial government halted MPAC’s reassessment cycle due to the COVID pandemic. Assessments completed in 2016 are now the baseline for municipal property taxes.

In 2023, the province announced a review of Ontario’s property taxation system to focus on “fairness, affordability and business competitiveness.”

Reviewing North America’s largest and most diverse property tax jurisdiction is difficult. MPAC assesses and classifies the value of over 5.7 million properties across Ontario with a combined worth of about $3 trillion.

Because it is an island, the County’s high number of waterfront properties makes it an outlier.

Ameliasburgh Councillor Janice Maynard wondered if there were property owners unduly burdened by a decade-long lag between property reassessments.

“In certain areas of the County, there are properties that have appreciated a lot faster than other places,” she noted. “The tax burden is being downloaded onto properties that haven’t appreciated as fast.”

Ms. Barr said MPAC “longs” for an assessment update but there has been no news from the provincial review.

“Until the assessment and taxation review is completed, we are in a holding pattern,” she said.

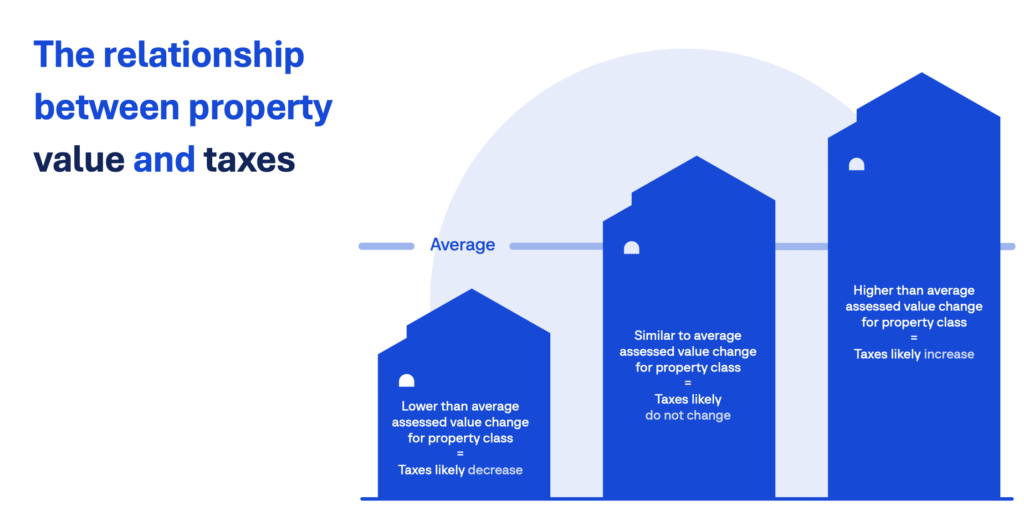

When the province does announce a new assessment cycle, the County-wide average increase will create a line in the proverbial sand.

“The most important factor to consider is not how much your assessed value has changed, but rather how the assessed value has changed relative to the average increase in your property class,” she said.

For example, if the average value for non-waterfront residential properties increases by 60 percent, and if your property value increased by 60 percent, then your tax rate will not change.

“If you see an increase of 70 or 75 percent, chances are your tax rate will likely increase. But if it’s lower, say at 40 percent, tax rates will likely decrease,” Ms. Barr said.

“There’s a lot of misconceptions. We hear time and time again, ‘I’m worried my property value will double. Then that means my taxes will double’. That is not the case. There is no one-to-one relationship; a property assessment increase does not equate to a tax increase,” she explained.

“Remember, property assessments are based on the current market and they only determine tax distribution. They do not determine the taxes paid. Decisions about how much tax to collect are made by local governments.”

See it in the newspaper